Before the snow starts later this year, we are finally launching a fully Guiide plan linked pension product with a provider and investment manager.

We are also adding partners income and savings for couples to plan together. We think this could improve more retirement outcomes. Here is why…..

Retirement is like cycling a hill, or skiing a mountain, you build up your pension pots on the way up (Accumulation) and then take money out of your pension pots on the way down (Decumulation).

Coming down, like retirement should be, is much more fun, but its also a lot harder and risky! Plus what you do near the top makes such a big difference to the whole journey down.

So why is decumulation much harder?

Firstly, your pot falling in value when you are young and building up money doesn’t matter too much. You are making new contributions and it evens itself out, but it matters hugely in the years just before and after retirement.

Secondly, you won’t just have pension pots. Working out how much money to take from your pots alongside other savings, incomes and other fixed pensions, such as the State Pension and any final salary pensions is complex. Even if you know what to take, actually getting it can be a pain. Try asking your pension provider for different amounts in different years, or even months…. good luck.

Finally, its a completely different mindset. You are now taking down what you have. Watching pots reduce vs watching them rise is difficult and worrying, the big continual question is…..will I make it down ok, have I got enough to last?

Pension providers don’t support the hard part well. This is why we built Guiide. Our aim was to help people who want to use flexible drawdown from their pots work out what to take and not run out. We provide an initial plan of how to take your pension pots which is expected to work, then a dashboard and tracker to keep updated.

The two current options

A small proportion people can manage decumulation, including their investment choices, on their own.

All they need is a low cost provider that offers a wide choice of DIY investments. We signpost some providers like interactive investor and Hargreaves Lansdown that offer a wide choice of investments.

Many others will much more likely to need greater help, or maybe pay for advice.

Again, we signpost some advisers like HUBFS and M&G Wealth on our site.

Advice is great, but like anything great, it costs money. The FCA estimate the average annual cost of ongoing advice (plus underlying product and investment fees) is around 1.9% a year based on this 2020 report here. This can seem expensive, or for people with less than £300,000 pots, it may even be difficult to find.

We will soon provide a new unique third option. A guided retirement product.

With the help of a pension provider and investment manager, this will provide more support, without straying beyond guidance.

How will the product work?

The plan you have built with us will work out if everything goes as expected. We all know things won’t go as exactly as expected and it may need altering from time to time, but we will come on to that later.

Given the plan built, the annual pension pot withdrawals within it can look completely different from person to person, depending on other income and savings.

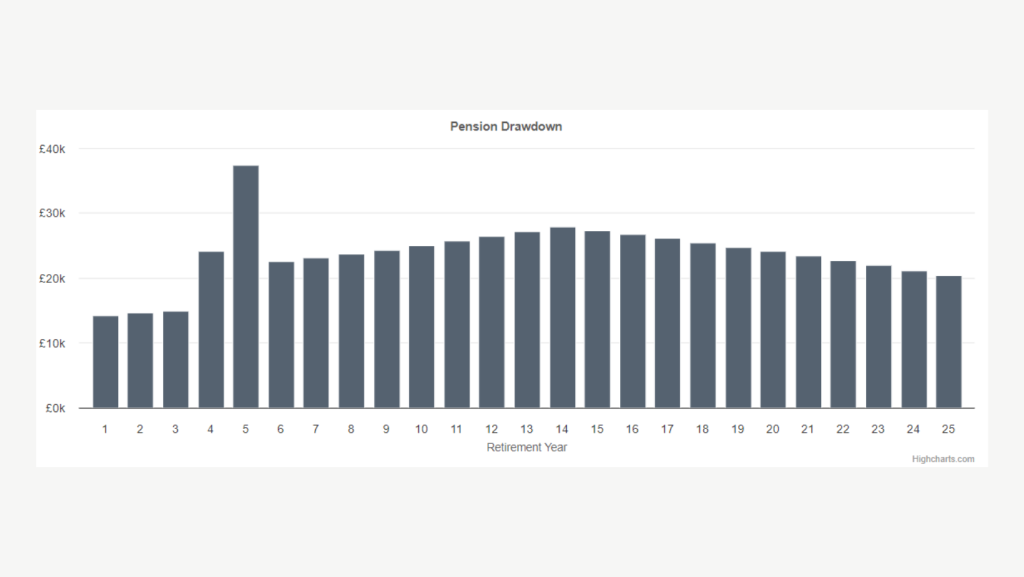

The tax efficient pension pot withdrawals needed each year for someone retiring at 62, getting a State Pension, a small final pension and having some savings may look like the chart below. These are not a simple steady stream each year. This is especially the case in the initial years when you may not be receiving the State Pension yet and have other savings to use, alongside pension pot withdrawals, to get the most tax efficient income.

So now we have a base set of pension pot payments for each year. The pension provider partner for the product will consolidate the pension pots you wish to put together to provide these.

They can also take any contribution payments you want to make before retirement. Then most importantly when the time comes, pay any tax free cash lump sum desired and the income payments you want within your final plan each month.

At retirement (and each March before and after retirement) you can adjust your long term plan ready for the new tax year, new tax bands, new State pension forecasts etc. You can then just expect the monthly payments wanted in the next tax year to be paid just as expected.

The live value of your pot will feed back into Guiide directly once you are logged into us (no more linking up of various accounts, or typing in manual pension pot updates). You can see what you have on any day and more importantly if its still expected to last given your current long term plan.

What about investments?

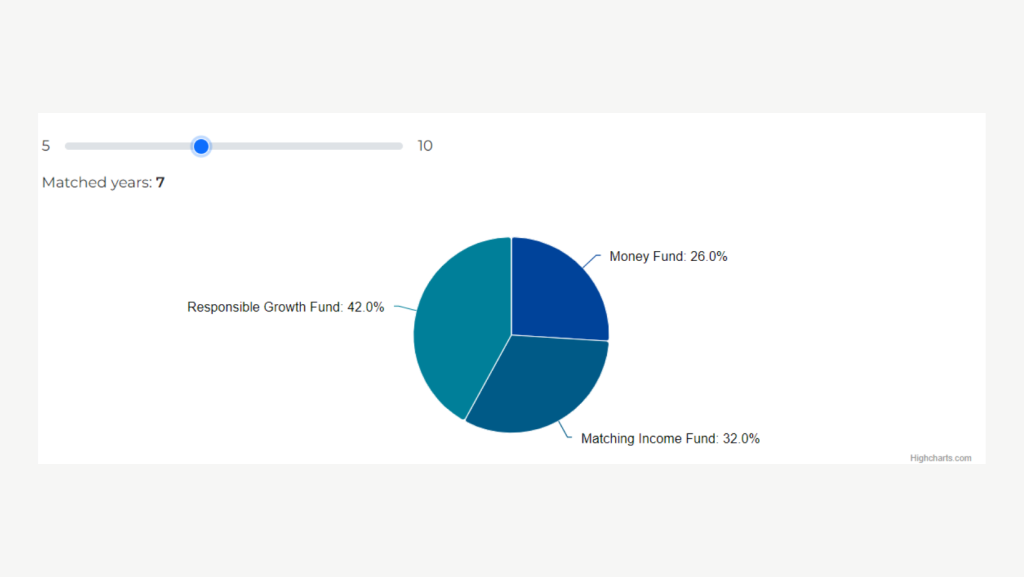

This is made simple, but tailored specifically to you. This is directed by two things. The payments you want from your plan and the length of time you want to match any future payments more closely.

This choice of matching years will be between 5 and 10. Much more detail will be provided later on this.

There will be three funds, all provided by the same large investment manager

- A Money Fund – to pay any tax free cash lump sums wanted at retirement and charges

- A Matching Income Fund – to match your income needs more closely over the period chosen by you, between 5 and 10 years.

- A Responsible Growth Fund – to try and achieve higher growth over the longer term

Based on your plan, your tax free cash lump sum choice, income needs and length of matching, your total pot will be split between the three funds. This is a far more tailored approach than all current default lifestyle funds offered by providers. Again here is an example of an allocation just before retirement, with the allocation moving towards this in the years before hand.

We expect many questions and some initial ones can all be seen on our new Product page. Just log into Guiide and go to the main journey. In the new Product page at the end of the main journey you can take a look at the annual pension pot withdrawals needed within your plan and the product’s at retirement investment split based on these like the charts above.

A few quick answers below.

What about my partners income, how does this fit in?

We have been wanting to add this functionality for a long time. It’s our most requested upgrade. We will be adding this at the same time as the product goes live.

We have been thinking and asking users how best to do this. We have decided once someone has built a plan for themselves, we will take everything their partner has and build the maximum total increasing income without shortfalls with it from the date the partner expects to retire. That way they will use their tax free allowance efficiently also. Once built it can then be bought into the main plan as “Partners income” in Other Income to help target a higher overall couples amount.

For those wishing to use the product, they can also transfer any partners pots to the same provider. The pension pot withdrawals from any partners pots could then be paid from one provider in line with an overall joint plan and the investment approach for the partners pot will be based on the partners cashflows.

Who is the product aimed at?

To start with anyone over 50 who has built and saved a plan without expected shortfalls in Guiide and is looking to use long term drawdown when they retire. It won’t be possible to accept any pension pots which have already started being accessed for income in the first launch, but this will follow shortly after, along with other features as we continually improve the offering.

Why don’t all providers use this approach?

Simple answer, investment manager doesn’t know the payments you want. By using your Guiide plan, you can let the provider know what you expect to need each year, whether you expect to take tax free cash and how many expected payments you want to put in particular fund choices. Based on the value of these expected payments, you can then model how much you want to place in different investment funds in Guiide. You can then provide this information to the pension provider and confirm your investment choices with them, which they will put in place for you.

What if I want some ad hoc payments?

No problem. If you need a lump sum payment that you did not think you would at the start, you can take this at any time. Some of the Growth fund can be used for this. You can even see what taking it means for your long term plan before deciding whether to take it.

What will it cost?

The three funds have different charges, but essentially the maximum charge will be between 0.7% and 0.9% a year in total (product fees and investment costs) plus any small dealing costs.

Are you interested in knowing more?

For the next three months we will be explaining more, providing many more details and understanding if this type of guided product is something people want. We believe nothing like this is currently available and there is a great need for this type of innovation.

If you have interest in knowing more, just leave your details below and will provide further updates over the coming few months. Also any feedback, suggestions or questions you have just email us at contact@guiide.co.uk and we would love to answer these.

I like the sound of this, keep me informed……

All of the above is intended for information only. Further details of the product will be provided in due course. Other pension products are available and if you are unsure on what type of product or investments could be right for you, we recommend that you seek regulated financial advice.