We take a look at the best route to adding a partners income into an overall couples plan as simply as possible.

Being able to plan as a couple is our most requested feature. We are building this now and it will be ready in July subject to ongoing discussions with the FCA as we need to ensure we do not unwittingly stray into advice with the tools we provide.

There are many ways to do this, but set out below is the first version of how we expect to. As ever we will listen to our users. So once up and running if we can improve things further (whilst still keeping it as simple as possible) please let us know.

1. Build your own plan first

Some people will only want a single plan. Others will have already built their own plan. We plan to keep this as it is within our main journey, i.e. just building a plan for yourself.

For those who have saved a plan and registered with us, they can add partners income in our Dashboard Area in the Partners page if you want to build a couples plan.

2. Understand the lifetime income you need as a couple

We need to check the income you want as a couple. You probably have used a single income previously so we need to convert this into a suitable couples income.

The income in your plan may be in as many as three parts.

- Everyone will have the main lifetime income wanted say £25,000.

- Some may have added a bit more in the first five years say £5,000.

- Finally a few may have changed the odd year or two in the chart for some lump sums.

It may be that you then reduced this target income if you saw some shortfalls. Let’s assume you did and reduced it by 20%. So your lifetime income was £20,000

We will take this lifetime figure and allow you to adjust it between 0% and 100% for a couple with a default suggestion of 50% (for many people costs may be around 50% more expensive as a couple).

Any added bits such as the £5,000 for the first five years will stay the same. So here just the lifetime income will change to £30,000 based on a 50% increase, but you can experiment with different levels if wanted.

3. Get a bit more info on your partner

We only need a few bits of extra info on your partner to build them a plan of their own.

- A separate email address will be needed for them, so this account can be linked

- When do they expect to start taking retirement income from

- Everything your partner has to put towards their income, just like in your Haves page

Everything else (like growth rates etc) for simplicity we would assume are the same as your own.

4. Target an income your partner can get without shortfalls

We will start by seeing if it may be possible for them to get the extra above your lifetime income to meet the couples lifetime income wanted.

In this case £30,000 less £20,000 so £10,000 per annum. This will always assume an increasing income at 2.5% a year, so we know it can fill the gaps in each year.

In addition to keep things as tax efficient as possible, if the amount above, i.e. £10,000 here is currently below your partners tax free allowance (currently around £12,000) we will use the tax free allowance instead.

This way you will always be using their whole tax free allowance as well as yours.

If this income isn’t possible we will reduce the income in 5% drops, like our current Solve take less until we can get a lifetime income without shortfalls for your partner.

5. Add it to the overall couples plan

Let’s say your partner could get an after tax income of £12,000 without any shortfalls. We will then let you bring this amount into your plan by linking the two plans together.

It will be called Partner’s Income in your plan.

Your plan is now a couples plan to get the total after tax income needed as a household.

This uses both tax free allowances and everything you both have. Both of you also have separate elements you can update as needed (when things such as pension pot values change).

Some questions and answers…..

Q. What if my partner will retire later than me?

A. We will bring in their retirement income from the date they plan to retire.

Q. What about their State Pension?

A. Like your State Pension, we will assume they get the full amount, but (like yours) you can always update this if they can estimate their total number of National Insurance years by the time they reach State Pension Age.

Q. What about investment returns?

A. We will assume they will get the same return on their savings and pension pots as you have entered for your own plan.

Q. What if they retire before you?

A. We will bring in the partner’s retirement income from when you plan to retire in the couples plan.

Q. What about different ages and life expectancies?

A. To keep things simple we will assume your partner is expected to live for the same period as yourself. This means the plan we build will provide a retirement income to last from when it starts to your own life expectancy in retirement.

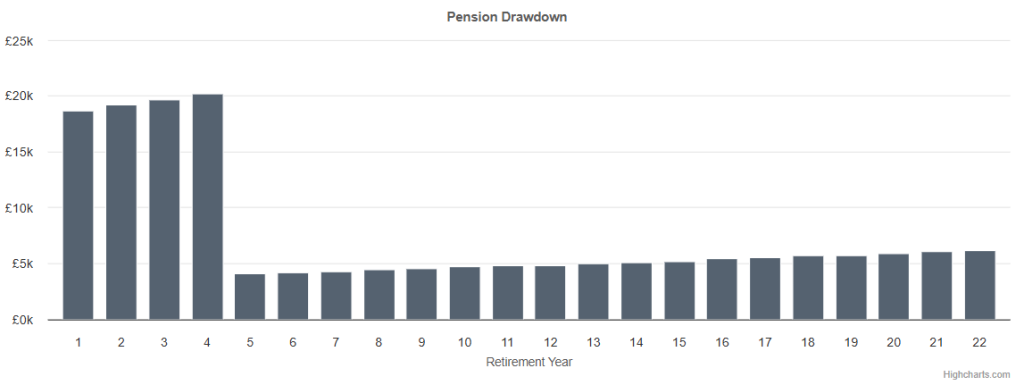

What do you and your partners pension pot withdrawals look like?

Soon after this is available you will see two sets of pension pot withdrawals rather than one as currently in the Secure page. They may look like below….

Yours (like you see now in the Secure page)

Your Partners (which you will also see shortly after this is all ready)

This gives you the key answer for both you and your partner to the question…

“How much to take each year from your pension pots to get what you need as a couple without running out?“

This assumes everything goes as expected. We all know it won’t, so it’s always good to keep tracking and refining your plans as time goes by.

Couples income within our new integrated product

When ready, you can use our couples modelling tools with your own pension provider or your own adviser. You don’t need to use our integrated product to access it, but if you choose to, it is aimed to make things more simple if wanted.

We aim to allow both yourself and your partner to be able to put all your household pension pots into this solution if wanted.

This would mean all pension pot income paid automatically as per the couples plan on the same day of the month from one provider. In addition, the tailored default investment strategy for both plans that you choose will be based on the payments you are both actually expect to take, not a one size fits all.

In short, as much as is currently possible under a non advised route will be done for you to make things easier and you can track and refine this over time much simply.

If you have any interest in this product let us know below if you haven’t already.

We are also always happy to answer any feedback, suggestions or questions you may have. Just email us at contact@guiide.co.uk if you do.

I like the sound of this, keep me informed……

Disclaimer

All of the above is intended for information only. Further details of the product will be provided in due course. Other pension products are available and if you are unsure on what type of product or investments could be right for you, we recommend that you seek regulated financial advice.