We take a look at investment issues when taking your money and how a solution integrated with our plans may help.

We have said in previous blogs that investment risk when drawing down your money is a lot different than when building money up. Let’s explain why and consider what you may be able to do about it.

Why is this?

When you are building up your pots some way off retirement, if the market falls, then to some extent does it really affect you too much at that point? You can’t touch your money for some time and you are making more contributions, which means you are buying at a lower price.

That’s a lot different to when you are nearing retirement or, actually in retirement. At that point you are likely to be taking your money soon, or already doing so to live off.

What matters if I am already taking money?

Every time you take some income that is the end value of that money. What you get is what you get!

In techy terms, you are either crystalising a loss or a gain.

If you are in investments which move up and down a lot, having to take money when they are down is crystalising at a bad time.

This risk may be higher in the years just after retirement. Why is this?

- Your pots are probably the largest they will be, so any percentage drop means a bigger fall in the actual cash amounts.

- Your State Pension (providing some of your income) may not have started yet if you retired before State Pension Age

- Some people spend more in the earlier years of retirement enjoying their new found freedom.

The last two points mean you may be taking more in these years, making any bad outcomes worse.

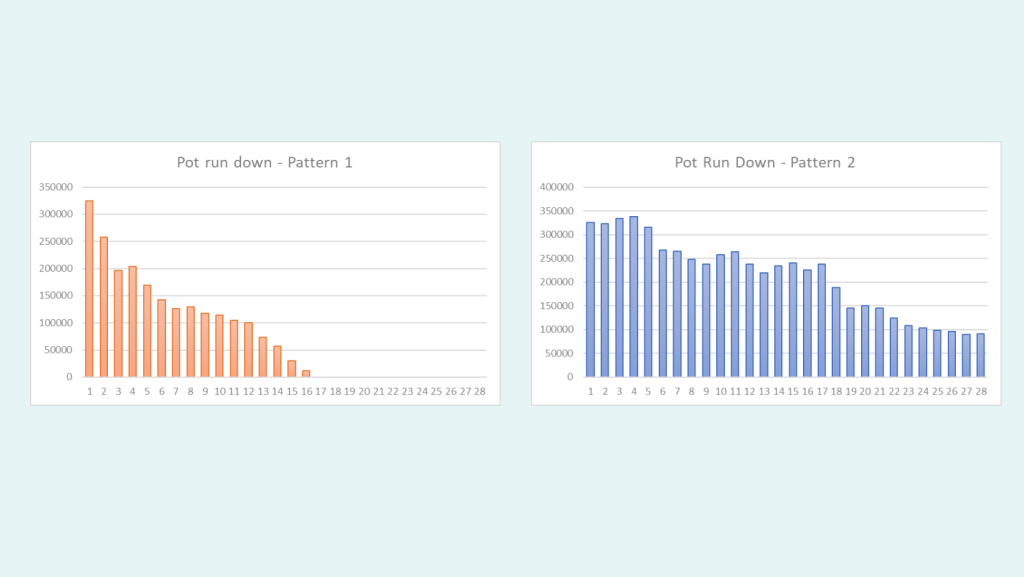

Below is an example. These are random annual returns each year in retirement. Both patterns average 5% a year over the whole 28 years. The first has many of the negative years at the beginning and the second has these in the middle or end.

As an illustration, for someone taking more income from their pots initially as their State Pension hasn’t started yet and they are happy with no increases from age 75, this leads to the following two vastly different outcomes.

Even though both take the same income each year and both get an average 5% return over the whole period, one runs out of money after 16 years whilst the other still has a pot of nearly £100,000 after 28 years.

The timing of returns is therefore very important as well as the overall average!

How can I try to avoid this when I am at or in retirement?

One way to try to avoid this is to consider the value the income payments you expect to take in these earlier years and decide whether to place these in investments which are less likely to go up and down so much.

Ideally you want to be invested in a fund with a very low risk of giving you a loss over a short term period, say 5 years. You could choose to allocate the total payments wanted in that period to that fund. This means you are unlikely to need extra money by selling some of the rest of your assets to meet these payments.

Two types of funds may help with this.

- Ones where the underlying investments mature at the right time to make the payment you need.

- Ones where the underlying investments get most of their return from income payments and with some downside risk protection.

With these, as long as you get the income or maturity payments, its much less likely you will get a negative return over 5 years than many normal growth type funds. Normal growth type funds, which invest mainly in UK and international share markets, may have a much higher risk that their values move up and down. The techy term is they may be more volatile.

Funds of this nature may still provide a good return, they may aim for a total return of 2-3% above cash. This may be a little less than a fund focussed on growth, but crucially aim to have a much lower risk of an overall negative return over say 5 years.

If you have put what you need in these funds, you may wish to leave the remainder in growth type assets. This may provide the possibility of additional longer term returns on money you don’t expect to need for income for some time.

What matters just before retirement?

As you approach retirement, if you are expecting to draw down your pots over time, or take a cash lump sum, a bad outcome is if the value of your pot falls just before you retire and start taking money.

Imagine a 20% drop just before you retire, that’s means your tax free cash lump sum is now 20% lower and your remaining pot to provide an income is also 20% lower right from the start!

How do I try avoid this?

In simple terms you may want to gradually move into the funds you want at retirement. You may want this to start happening in the period 5 to 10 years before retirement.

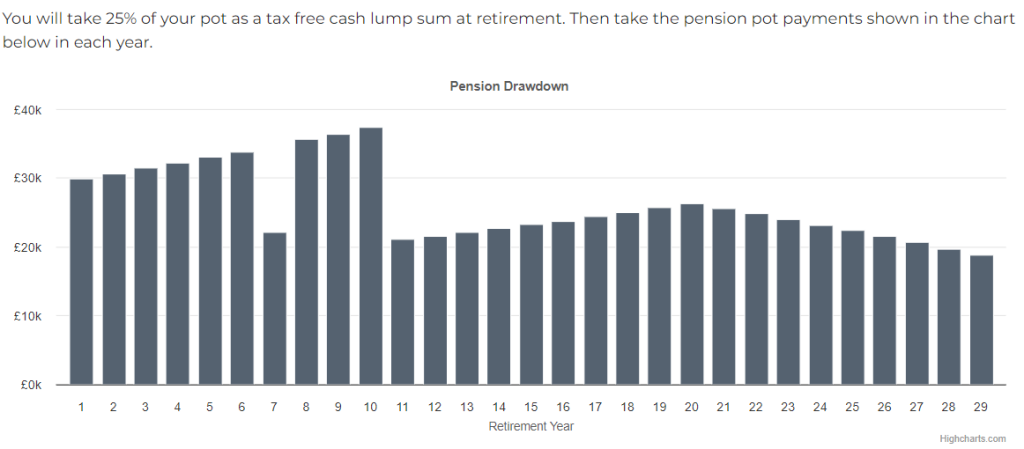

Let’s take the example pension pot payments to give the total overall income you may want below. Let’s say you want to place the first 5 years payments in a less volatile fund when you retire.

- 5 years away from retirement you may still be in all growth type assets as you don’t expect any payments for the next 5 years.

- 4 years away the first years payment you expect comes into that 5 year period, so the amount you may need for the first year in retirement could be moved into a less volatile fund.

- 3 years away and the first 2 years are now in a less volatile fund

- 2 years away, first 3 years etc

Gradually this moves you to the split you need at retirement based on your specific plan and period of cash flow payments you want in a less volatile fund.

Then once you retire, you can either decide either to let the 5 years of payments run down to zero as you age, or keep the period of 5 years constant. If you do the latter the value of the next 5 years payments are always in a less volatile fund on a rolling basis.

Tax free cash

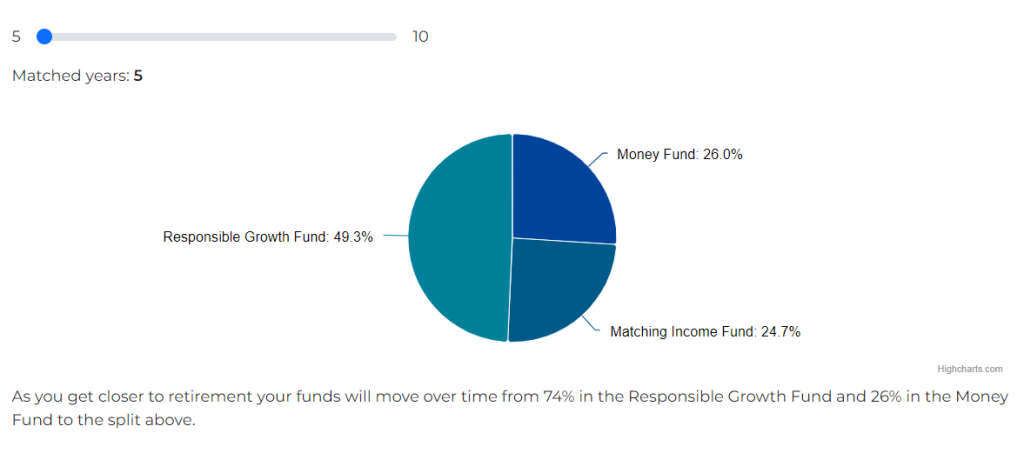

Another big factor to consider before retirement is whether you expect to take a 25% tax free cash lump. If so, having 25% of your pot (plus 1% to meet any fees) in a cash/money type fund as you near retirement may have advantages.

This total 26% in a money fund means if you decide to take your lump sum at any point before your expected retirement, the cash is there to pay it. This reduces the risk you need to sell 25% of your total pot to pay your cash lump sum at a bad time.

Well performing money funds, made up of very short term cash deposits and debt, may return savings account type returns each year. The reduction in overall pot growth could be small, but the risk above may be reduced.

Why is this approach different to current default funds?

If you pay for advice an adviser will work out all the above for you. They will design you a tailored individual investment strategy. However, a large proportion of people do not take advice.

A large proportion of those who don’t take advice may use default funds. Lots of current default lifestyle funds gradually move people from growth type assets into more matching type assets which seems good.

However, they have one key flaw. They do not know what type of matching asset may be right for you.

- If you want to take some or all of your pot as a lump sum, then cash may be the best matching asset for some, or all of your pot

- If you want to use your whole pot to buy a guaranteed income at retirement, then long term bonds may be the best matching asset for your whole pot.

- If you want to take your pots flexibly over your lifetime, then the best matching assets may depend on your expected cash and income payments you expect to take.

Put simply, as the provider and investment manager have no idea how you expect to take your money, it does not seem possible they can get this right on an individual level, they need to guess.

As the FT points out in this article this has led to some bad outcomes. Many people were automatically moved into long term bonds at retirement, even though they had no intention of ever buying a guaranteed income (annuity).

Those bonds fell in value heavily when interest rates rose. For those buying a now lower priced annuity, no real issue, but most people were not. These people simply had a much lower pot at retirement to take cash and/or income from.

How can Guiide help?

From your current plan built with us we already know:

- When you expect to retire

- Whether you expect to take a 25% tax free cash lump sum

- The pattern of income payments you expect to take.

We can also ask…How long would you like to place the expected income payments in Income based funds for? We allow a range between 5 and 10 years.

By providing this information to a provider and investment manager they can split your pot between three suitable funds.

Here is an illustrative example below.

This is one of the main features of the new guided retirement solution we are providing soon.

Each year you may change your plan, but once we know your latest updated plan, your investment split is taken care of for you automatically based on your plan and choices. Its like a default fund, but you provide it more information based on the choices in your plan. Your plan may even be extended to include your partner’s income and choices also once we incorporate this.

Does this sound interesting?

If you have any interest in this product let us know below if you haven’t already.

We are also always happy to answer any feedback, suggestions or questions you may have. Just email us at contact@guiide.co.uk if you do.

I like the sound of this, keep me informed……

Want to ask us questions about Guiide, pensions or savings in general?

Now we have over 10,000 registered users we want to hear the questions you may have. We are soon to launch one hour online “ask us anything” type sessions on the first Friday at 2pm of each month. The first one will be Friday 1 November at 2pm.

Kevin Hollister (Pensions Actuary) and Dianne Sullivan (Financial coach) will be in the online meeting to answer any questions you have about using Guiide, pensions, retirement and other long term savings.

These sessions are not about trying to sell products or services, they are just about helping our users. Helping you understand pensions better and getting to know your issues and needs so we can improve.

Pensions are complex so no question is daft or too difficult, please just ask. (Although we may need to follow up via email with an answer if really difficult).

The only thing we can’t do is offer any type of advice, just provide factual answers.

To allow people time to ask and get answers we will limit the sessions to 25 registrations. If popular, we will do them more frequently. If it’s tumbleweed, we will stop after a few.

Just click the link below if you want to register to attend

Disclaimer

All of the above is intended for information only. Further details of the product will be provided in due course. Other pension products are available and if you are unsure on what type of product or investments could be right for you, we recommend that you seek regulated financial advice.