Planning your finances is a vital part of preparing for retirement. It can influence when you retire, as well as what type of lifestyle you expect – but you need to use the right tools.

There are plenty of options available to help you with this crucial task. However, basing your decision-making on wrong or incomplete information could be as effective as 10-pin bowling with an old golf club.

Simple planning tools

The internet is awash with simple pension planning tools. We love keeping things simple, but sometimes you need to go beyond the basic options to get the information you need.

The majority of pension planning tools ask:

– What size is your pension pot?

– How much do you want to take each year?

– What growth do you expect on your pots?

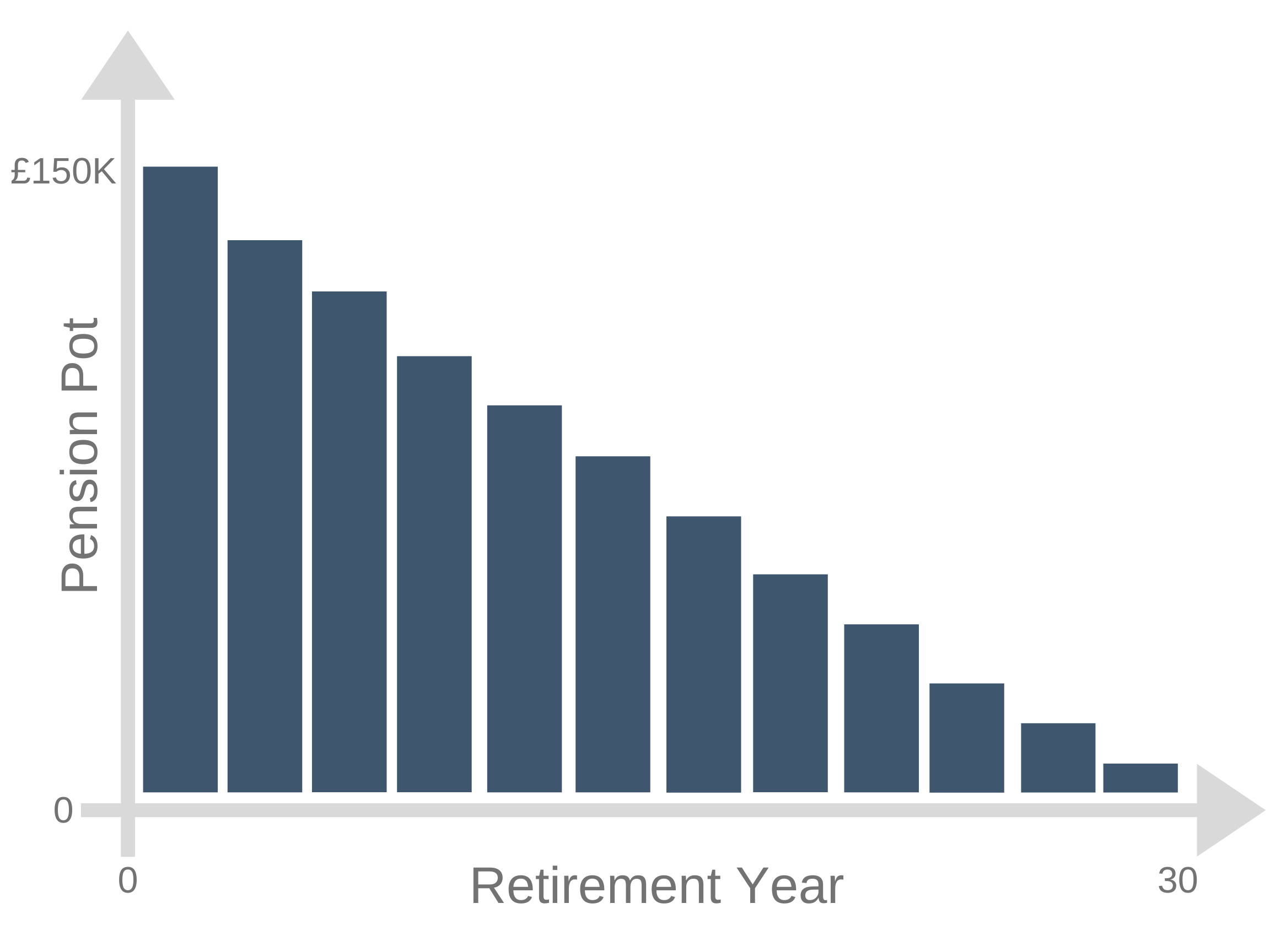

They then give you a nice chart like this, telling you how long your pots will last:

Great yes?… No… unfortunately this chart has no practical use at all for planning your retirement income, because it assumes your retirement savings will gradually reduce over time in a nice, straight line. If only life were that simple.

Here are some other tools that can help to bring a bit more reality into your retirement planning.

Holistic tools

Holistic means ‘including everything’. Hardly anyone reaches retirement with only one pension pot to provide for their future.

As well as any other pension pots from previous jobs. There are so many other sources of money that can also go towards funding retirement. These include:

• State Pension (nearly everyone gets at least something even if not a full State Pension)

• Benefits (many people are entitled to benefits in retirement)

• Previous final salary scheme income (most of these schemes are now closed, but you may have benefits from a previous employer)

• Part time or occasional work

• Savings, such as ISAs

• Lump sums from property etc

• Rental income

It is highly likely at least one of these will help support you in retirement, in addition to any pension pot you put into a modeller. It may only do so for a while, or it may start at a later date than when you want to retire, but they need to be a part of your retirement planning.

In short, take account of every source of money you have available to you. Many people will need to do this to create a retirement income they can live off, given the much-publicised shortfalls in pension saving that we see in the UK.

Tax planning

No one cares what their income will be before tax, they care what it will be after tax.

Pension pots, pension income, savings and other income are taxed in different ways. When you build a retirement plan you need to understand how much income you’ll need after tax. You’ll also want to manage your retirement savings in the most tax efficient way.

Again tax planning needs to take into account everything you have, to understand what types of savings and other income you can use to best advantage in different years. That includes understanding how different types of income are treated from a tax perspective, so you get the after-tax income you want and pay the least tax possible. That way, your pension and saving pots will last longer.

How to build a plan that works

One option is to take financial advice. A good adviser will build you an holistic plan that is tax efficient. It will be designed to give you the income you need, whilst minimising your tax.

Most people do not take advice, as they do not wish to pay for it, or cannot access it. Instead, they try to plan on their own. If you are going to do that, you need the right tools.

That is why we built Guiide to help anyone who chooses to do their retirement planning on their own.

As we say, we like simple. So, we’ve kept it simple. Just tell us what you want in retirement and everything you have to put towards it.

We then do the rest, building you an income plan and making it tax efficient.

Best of all it’s free to use and subscribe to and we will soon be adding a number of other great additional features to help you navigate retirement.