How much do you need in your pension pots?

The answer to this question will depend on various personal factors. In addition to doing the numbers, here are a few things to keep in mind when you calculate how much you’ll need in your pension pots:

- When do you want to retire and what type of retirement lifestyle do you want?

- Do you want a flat income or one that goes up with inflation?

- What else do you have alongside your pension pots?

- How much will you need to pay in charges?

Deciding when to retire and the type of lifestyle

The later you retire the less money you will need to last your entire life. To keep it simple we will consider a typical retirement age in our number calculations: 65.

Predicting how much you’ll need for retirement isn’t simple. If you’re not sure where to get started, The Pension and Lifetime Saving Association (PLSA) have a great website that offers guidance on calculating how much you need after tax in retirement depending on your lifestyle. They go into quite a lot of detail to help people understand exactly what each type of lifestyle means. We incorporate these figures in Guiide so you can easily select each one and compare.

We will look at the amount needed for each lifestyle choice in our numbers below.

Picking between a flat or rising income

Most people choose a retirement income that goes up with inflation. This allows them to buy the same amount of items with their income in future years.

However, if we look at retirees’ financial data, we can see that spending tends to be higher in the initial few years after retirement when people enjoy their new found freedom, then lower in later years as people become less active.

With the same size pension pot you can choose to get a much higher initial flat income than one which increases with inflation. Given the spending pattern above, this may well be a better choice for many, especially if their pots are more limited.

We will look at both options in our number calculations.

Taking into account everything you have

Nearly everyone will get a full or partial State Pension once they reach State Pension Age. In addition to the State Pension, some people may get an old final salary pension, offering further guaranteed income. They may also have some non pension savings, rent from property or even a part time job for a few years.

Everyone is different and what they need depends on what else they have. To keep it simple, we will assume in our number calculations that the retiree gets a full State Pension but has nothing else to put towards retirement except pension pots.

Doing the numbers

Jenny is currently 55, in average health and is considering retiring at 65. She lives outside London, will only support herself in retirement and will put all of her pots together with one of Guiide’s low cost provider partners.

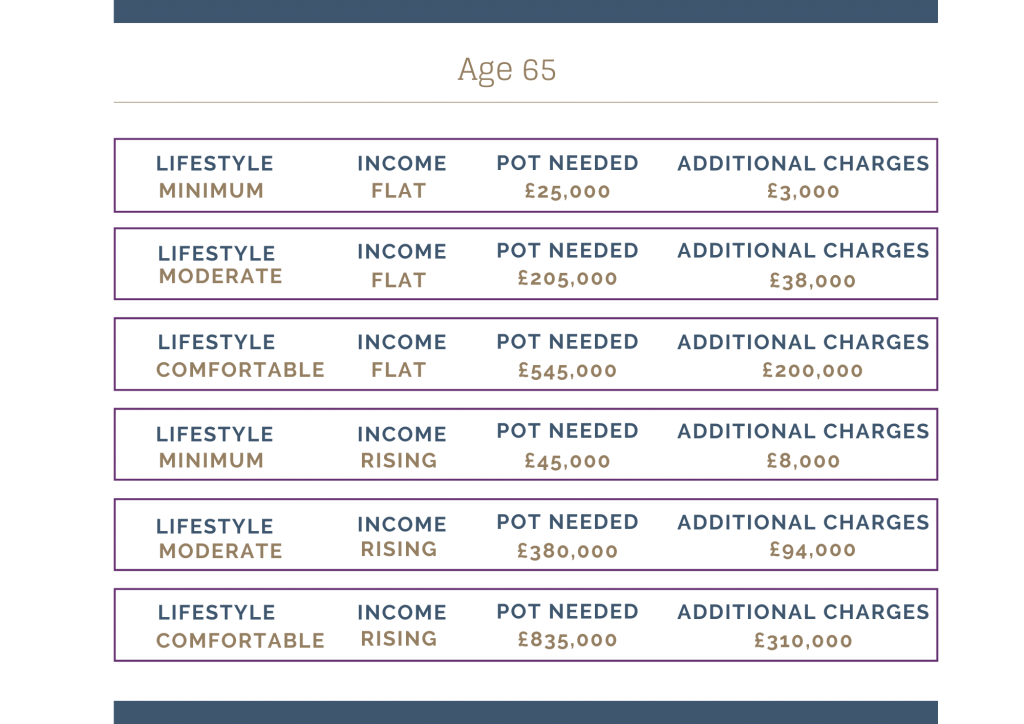

She only pays around 0.5% a year in charges and estimates her pots will grow at a rate of 3% per year – so 3.5% before charges. If she decides to go with another provider she will instead pay the industry average of 1.5% total charges. Unless she gets an extra 1% return each year, she will be worse off from these additional charges. Here are what the numbers look like in a table:

Key takeaways

- Minimum retirement lifestyle only requires a small pension pots when combined with the State Pension.

- You need much larger pension pots for an income that increases with inflation. Given typical spending patterns, a flat income may sometimes be a better choice.

- Paying just 1% more in charges per year can add up to a lot over a whole lifetime.

- Extra charges mean having to get a higher return to make up for these. If you don’t achieve this higher return, the added charges may mean you need to take a lower income in order to avoid running out of money. Is this an extra risk that you want to take?

Guiide lets you build a plan to suit any lifestyle at the retirement age you want. Build a free plan, see what you need to save, and how to take your pots in retirement without running out of money, or overpaying tax and charges.

One thought on “How Much Do You Need in Your Pots for Retirement?”

Comments are closed.