You told us you would prefer smoother income in the early years of retirement, here’s how we can help.

Retirement may last between up to 30 years for many people.

No one knows how long it will be, which is a big risk in itself and a whole different topic. But for now, let’s assume we do know and look at the investment part of the risk alone.

Drawdown income isn’t guaranteed as you can run out of money or (more likely) have to reduce the income you initially wanted at some point going forward, as it will become likely you will run out.

What you told us

We recently asked if given a choice, which part of your retirement income would you like to make more certain?

The answers were well in favour of earlier income – the income you need between retiring and around mid-70s for many people. Let’s say the first 15 years.

We haven’t forgotten about those who favoured later income and a solution for that will be developed. For now though, let’s look at on how using Guiide to build a plan, alongside investments built for the plan by an expert, can make the first 15 years payments more certain.

Current drawdown investments

Investment in drawdown is a lot different from when you are building up assets. Tell me why.

Assets can go up and down. When assets go down as you are building them up, it matters less. You are paying more contributions and buying assets at the new low price, so it usually evens out over time.

When you are taking money from your pots it’s much different. If you need to sell (to take income) when the assets have gone down, in effect you “bank the loss” on the assets sold.

You won’t get the chance for the assets to recover in value or buy more at a lower price to even out the loss.

Current drawdown investments don’t seem to allow for this. Many popular ones that providers offer as their default investment in retirement are simply made up of around 60% in less risky assets, like Government debt (let’s call them Bonds) and 40% in more risky assets to get some growth, like company Shares.

When you need income these are just sold in that 60/40 mix at whatever price they are valued at, turned into cash at that time and paid to you.

What it means in practice?

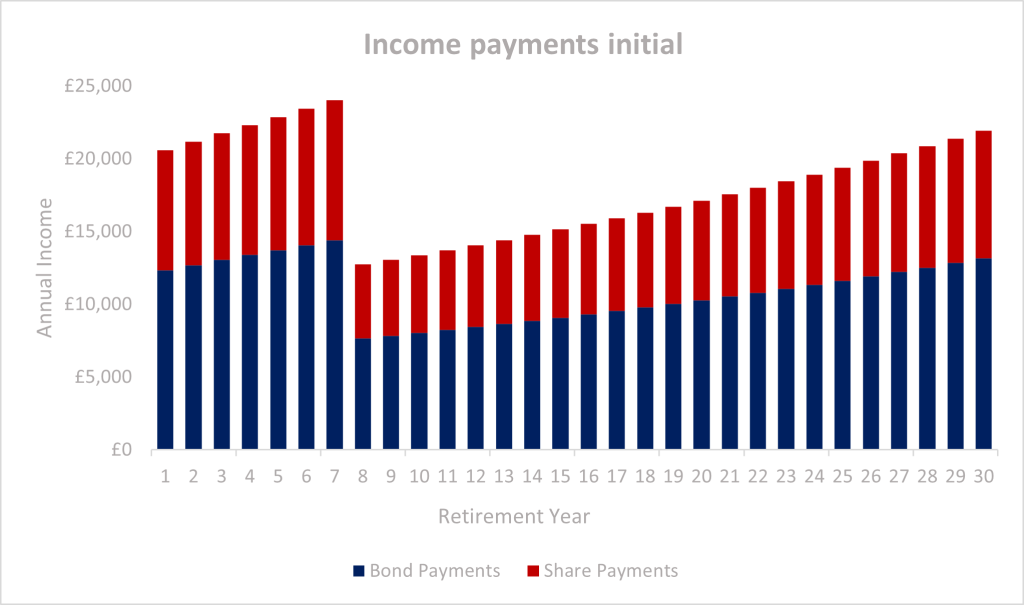

Below is an example of the pension pot payments someone aged 60 needed, if they are expected to live to 90. They have a state pension at 67 also and want a starting after tax income of £20,000, which increases at 2.5% each year.

Here is what the assets to meet what they want will look like, (remember they need less from your pension pots once the State Pension starts). Each payment needed will be made by selling the amount they need in the split below.

What’s the risk here, if this is you?

You are selling some Bonds and Shares each and every year. If these need to be sold at a time when they have gone down in value you have “banked the loss” at that time.

We all know that Share prices can rise or fall a lot day to day. Many people don’t know that even the price of the safe part (Bonds) can do the same. Why is this?

This is because they are expected to actually pay back your money in many years time. Without getting too techy, if interest rates rise/fall by 1%, the Bond price falls/rises by about 8%. Think about how much interest rates have gone up recently? That’s a big fall.

So in this case, both the Share and Bond prices can change a lot at the same time. This leads to more chance of having to “bank a loss” and reduce the income you can take in future.

Is there a better approach?

We are actuaries, not investment experts, but we do know a bit about how to reduce risk. Speaking to actual investment experts, between us, we think there is a way.

If you hold a Bond until the date it is paid back. If it pays you back you get a guaranteed return. Let’s call the types of bonds you hold till they pay you back, “Cash”, as they are more like a known Cash payment.

This means if you know the payments you need for the next three years this Cash can be there to pay you. You can then keep moving more into Cash each year to cover the next three years payments. At any time then, your next three years payments are expected with pretty much no risk at all.

Will I lose a lot of potential growth?

Not really. You will still hold Shares to hopefully get more growth. These will just be aimed at paying more of your later payments. They will still go up or down in value day to day, but because you do not need to sell many during the first 15 years, your payments are much less likely to be affected.

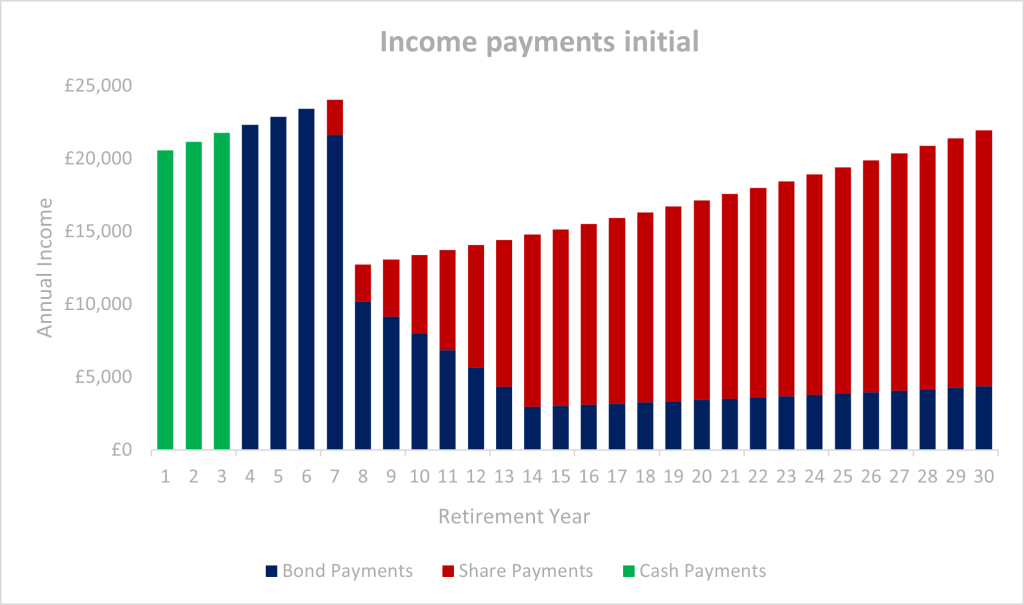

Here is what the initial mix to meet your future payments looks like.

For your first 15 years payments the assets used to pay these are likely to be much more stable. Most of the riskier parts are initially designed to pay the later payments you need. This means a lower chance of having to reduce the earlier payments.

These investments also move over time as explained below.

How do they change?

Looking down the line, most current default investments stay very much like they were at the start. They are static, i.e. they have the same mix whether you are 60 or 85. This means you have the same risk of having to sell assets at a low value on every future payment wanted.

In the other approach, the investment mix changes slowly over time. So 15 years into retirement the next three years of payments are now in Cash again, i.e. they are moved slowly from Shares to Bonds to Cash over time to meet the next few years payments.

Why don’t all investments look like this?

Simple answer, the investment manager doesn’t know the payments you want. By using Guiide, we can let them know what you want each year and just have what you expect, paid to you. They can then create the right mix for your payments.

What if I want some ad hoc payments?

You can still maintain this flexibility. If you suddenly need a lump sum payment you did not think you would at the start, some of the Shares and Bonds backing the later payments can be sold to pay you this.

These may need to be sold at a time when values are low and if you take an ad hoc payment, this will lower the pot value. Both increase the chance the later payments can’t be made in full, but the flexibility of the pension freedoms is still there if you need it.

Guiide will support you by showing you if the later payments can still be expected in full after any ad hoc payment, so you can see this before requesting one.

Whether you take any ad hoc payments or not, our tracking tools are always there anyway to keep you updated whenever you want to see if the later payments can still be expected in full.

Is there more risk with this in the later years?

After the initial 15 years, the remaining income payments possible will depend mainly on how the Share part of the fund has performed over this period.

The later payments hold a greater proportion of Shares, so will be more risky, but as these will be gradually moved to Bonds then Cash over time, this risk is lower than if the strategy was static.

Overall though there is some more risk of the full later payments not being possible. There may be upside or downside.

On the upside, if the Shares have done well over time, you may be able to take some more income later, leave more to your family, or if much better than expected even buy an annuity to fully guarantee your income no matter how long you live.

On the downside, you may need to reduce your desired income from this time, leave less to your family, if the Share part has performed poorly.

However, as discussed in our previous blog around lifestyle changes, many people feel they may feel more comfortable having less income than expected in later years when they are less active.

Roundup

Many current default investments for drawdown seem far from ideal. They may mean selling a lot of risky assets at any time when their price is low.

They also take no account of many retirees’ lifestyle. Forced reductions in income in later years when you are less active, may be less of an issue for many, than forced reductions in earlier years.

Usually access to more cashflow based investments are only there for those who pay for advice each year. However, by combining Guiide with an investment manager’s expertise, this approach can be there for all.

We are looking to develop a new version of our Guiide.auto product within 6 months to do this. This will be with an experienced low cost pension provider, who already has around £2bn in customer policies.

The investments will be provided by an expert partner (currently managing over a trillion of assets worldwide). Our aim is to make something that is very difficult for the millions of people trying to do this without advice, much simpler.

As we always say, we only develop what our users want. If there is interest in this when you get close to, are at or are in retirement, please let us know below by registering interest below.

I like the sound of this, keep me informed……