The launch date of the UK’s pension dashboard is approaching – but it will offer the help people really need?

At some point in the future a Government pension dashboard will exist, where hopefully, you can provide your National Insurance number and get details of all your pensions. This will include pension pots, any Final Salary pensions and your State Pension.

This is absolutely great…but we think it lacks two key parts. That’s why, ahead of this launch, we have decided to build our own version to address these points .

1. Retirement is no longer just about pensions!

Many people will continue to work part time after starting to take their pension pots. Many people will have used housing to save towards retirement (how many times do we hear “my home is my pension”). They may take some release equity, or rent out a property. Others will have different forms of savings, such as ISA’s to put towards retirement.

OK you get it, its not just about pensions. Instead, in today’s world, many different things may play a part towards a retirement income for lots of people.

If you are going to have a retirement income Dashboard, you need to include everything, not just the parts traditionally thought of as “pensions”.

2. When you have a Dashboard (even with everything on above)… what next?

Its all well and good seeing everything you can put towards retirement in one place. But what do you do with it? What does it mean in terms of your retirement income?

What do you really want to know – will I have enough income for what I want, for the rest of my life?

Most people won’t know how to convert all their pension and savings pots and pension and non pension incomes (starting and ending at different dates) into one total retirement income to give them what they want.

That was the whole reason we built Guiide. In simple terms, its asks what do you want after tax and what do you have. It then shows you how can you put it all together to get what you want in a tax efficient way.

This isn’t just a plan at outset. You can track and adjust it as things change (which they inevitably will) over time.

A Dashboard is great on its own for information, but without the figures being directly fed into the type of calculations we undertake to work all this out for you, it offers little practical value for someone planning their retirement.

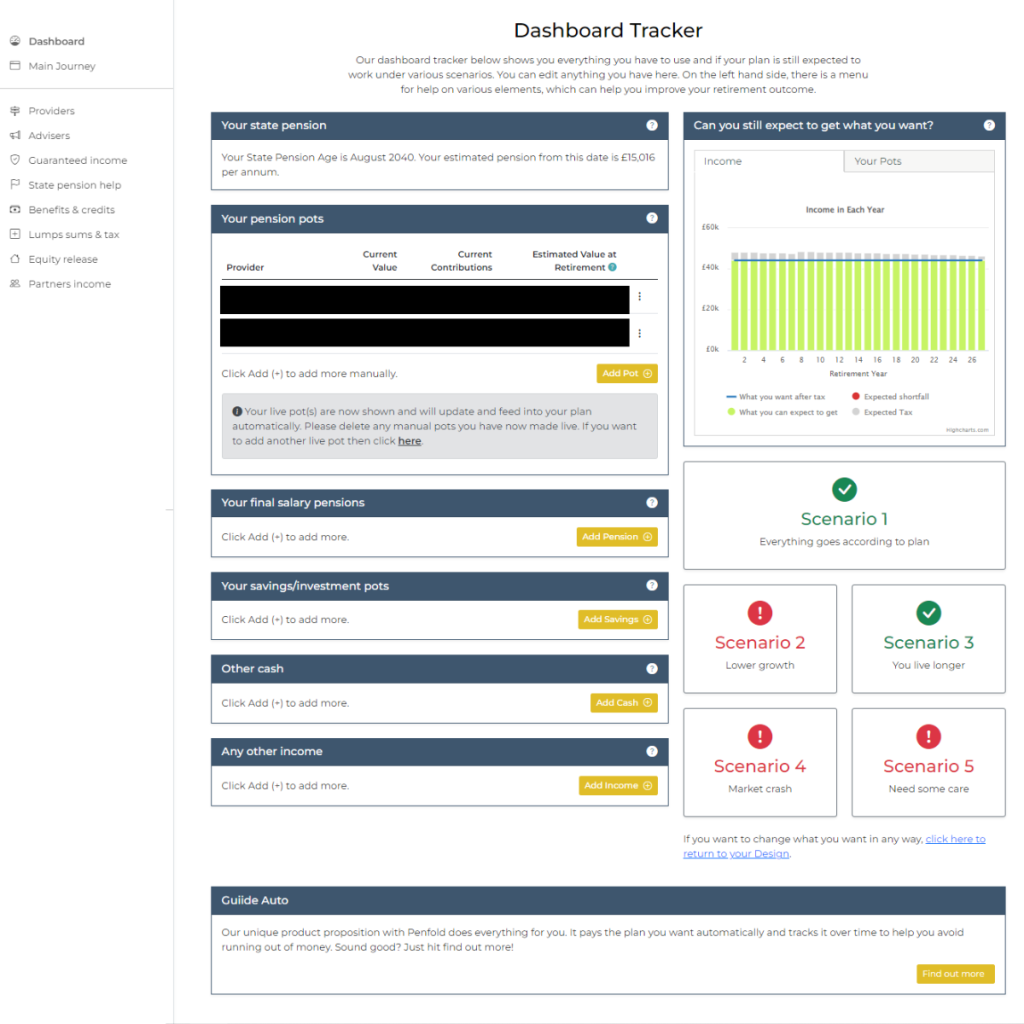

Our new Dashboard Track and Help area

Our own Dashboard with added features to make it practical for real life. To be clear this is not a Dashboard where you can simple put in your national insurance number and get all the information.

Instead, you can simple link the parts which change day to day, like your pension pots, to get live values coming through daily.

Everything else like State Pension estimates you can add yourself with some help from us to get the right amount. Base elements that change annually, like the State Pension and income tax bands update automatically, once they become known.

This gives you an overall Dashboard of everything you will put towards your retirement income with the parts that change value day to day updated live and other parts once they become known.

But….its better than that! The values directly feed into our calculations. These give you an update on any day you log in to see whether your plan is still expected to work if everything goes to plan. Even better, it shows our four typical real life scenarios where things may go wrong or you may need more money. These scenarios are updated live also.

In short, in one page, you can see everything you have, with latest values of your pension pots whenever you want, and right beside it, see if your plan is still expected work based on the latest know position.

More added Help

On the left hand side of our page we also offer many areas of Help. These can make your plan more accurate, help make retirement more sustainable, lower the costs involved and even reduce the hassle of actually being paid what you want each month once you retire.

Around 120,000 people each year enter drawdown (taking their pension pot income flexibly each year) without the help of advice. Millions of people plan to do so at retirement.

For all these people we think our new Dashboard, Track and Help page gives them most of the support they need to manage retirement themselves and vastly improves just trying to manage it alone. We wont be stopping here though and will be adding more features (such as partners income) over time.

Sound helpful? Already a registered user login here and just click Dashboard.

Not registered yet? Build a plan here today in 5 minutes and then see our new Dashboard once you have registered at the end.