“You and I are gonna live forever’ sang the rock band Oasis back in the 1990s.

Unfortunately we won’t, but we do all need a financial plan that will protect us if we live longer than we think.

No one really wants to think about when they may die. It’s not the most uplifting of subjects, even for actuaries. But if you are planning to make sure your pension pots will last throughout your retirement, it’s important to understand how long you can expect to live for.

In simple terms, someone currently aged 60 in normal health (and mostly likely not an ageing rock star) can be expected to live on average to around the ripe old age of 89. That might not be as catchy as Oasis’s lyrics, but it is a good deal more accurate.

Assuming you are the average Jane or Joe in terms of health, you will want to plan to manage the money in your pension pots so that they last until you’re 89 at the very least.

But what if I turn out not to be average?

The problem with trying to work out your life expectancy is that what actually happens for you as an individual will be very different from the average.

It’s quite easy to predict how long a large group of people might live for on average over time, but it is impossible to predict life expectancy for one individual. Some people will live to a hundred, while others might die aged 70 or younger.

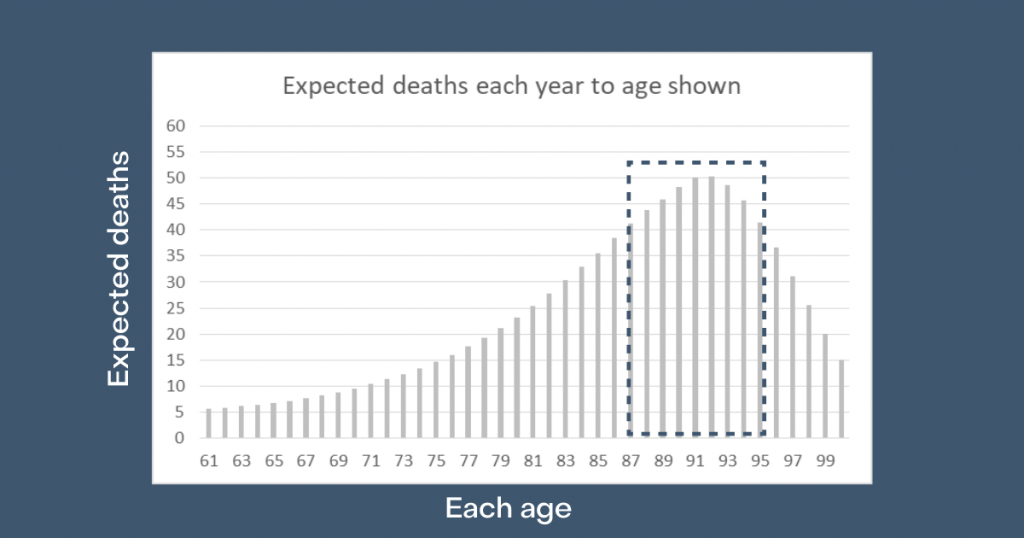

Let’s look at some numbers that show the age at which a sample of 1,000 people, all aged 60, may be expected to die.

- It shows that around 5 out of 1,000 will die aged 61

- Around 50 out of the 1,000 will die aged 90

- The most likely ages to die are somewhere between 87 and 95

What is my chance of reaching a certain age?

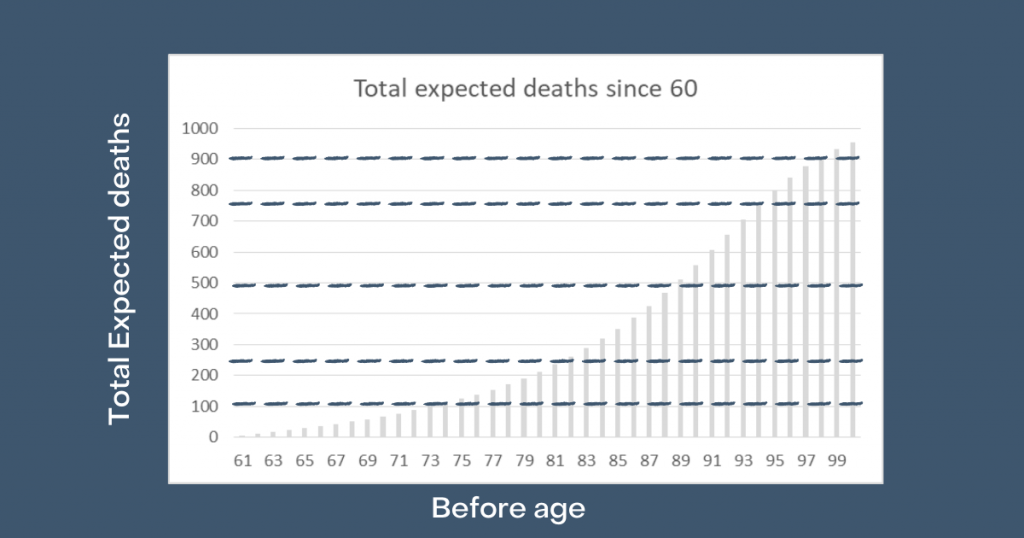

Using the same numbers, what is the chance of reaching a certain age if you are aged 60 now?

- Only 100 out of the 1,000 will not reach 74, meaning 900 (90%) will make their 74th birthday

- 250 are expected to die before 81, so there’s a 75% chance of living until then

- Around half, 500 people will live to 89

- A lucky quarter, 250 people, will get to age 94

- Finally a very lucky 100 out of the whole 1,000 will make it to 98, some of these may even make a century

- Sorry, Oasis, but no one will live forever!

What does this tell us?

It is relatively easy to predict the deaths at various ages of a large group of people, but for one individual, no one knows what will happen in the future.

There is such a large range of outcomes, that being certain of taking the right amount of money from your pots to cover everything you need today without running out tomorrow is just impossible (unless you have very large pots in which case you can afford to live a lot longer).

Even using average life expectancy to target how long you need your funds to last means there is still a 50% chance you will need your pots to last longer. In other words, one in every two people would run out of money if they use this as a calculation.

Given that it is impossible to predict how long you will live, using drawdown alone to provide a retirement income might not cover all your needs. It’s very hard to plan drawdown when you don’t know how long your money needs to last. It takes time and thought as you go along, and most retirees have better things to think about, like enjoying themselves.

What can we do to improve this?

There is some good news. Nearly everyone will receive a State Pension of some kind which is paid for as long as you live. It is unlikely to provide everything you need, but it will contribute towards it.

Some lucky people will also have a final salary pension from a former or current employer, which is another source of guaranteed income for life. If you have one, your final salary pension plus the State Pension may be all the regular income you need.

However, many savers will qualify for the State Pension, but will have little or no final salary pension when they retire. Instead, they need to use the pension pots they’ve accumulated from defined contribution saving to create the rest of their regular income.

We’ve seen in other blogs how you can use drawdown to convert your pension pots into a regular income. But drawdown isn’t the only option.

Instead you can buy a guaranteed income for life, often referred to as an annuity, with a percentage of your pots.

An annuity provides a regular income stream which, combined with the State Pension, might cover your day-to-day needs and still give you the flexibility to use the rest of your pots for drawdown.

But I’ve heard that no-one likes annuities…

They were unpopular in the past, but that was partly because you had to use 100% of your pot to buy one, giving up all flexibility.

Now you can simply use some of the money in your pots (say, 20% or 50%) to provide guaranteed income and still keep lots of flexibility.

But don’t I lose everything I have put in if I die early?

This is no longer the case. Many annuity products come with guaranteed lump sum payments on death. Some even have a surrender value for a period, so if your health takes a turn for the worse, or your financial circumstances change, you can get some of your money back.

But they cost so much…

Perhaps not as much as you think.

Insurers can accurately predict how long a large pool of people will live for over time, but like you they can’t predict this on an individual level. They don’t like unknowns, so they will assume the worst outcome for them (i.e. they will assume you will live longer than average, as that costs them more money).

However, by finding out more about your health and lifestyle, using a process known as underwriting, you can now often get much better terms.

Putting yourself in a pool of insured lives means that if you live longer, you receive a financial benefit just from surviving each year. You may not care about this when you are very old, but it gives you the freedom to take more money from the flexible parts of your retirement funds when you are younger, provided you are sure you will have enough in your later years.

Another benefit of a guaranteed income is that you don’t have to worry about how your investments perform once you’ve bought an annuity. This is especially beneficial in your later years, when thinking about how to invest your money is probably the last thing you want to worry about.

As there is no personal investment risk on an annuity, you could even consider taking more risk with your remaining funds (and therefore benefit from the opportunity of more growth).

So how can I add some guaranteed income to my Guiide plan?

Later this year, within Guiide.auto, you will also be able to add some guaranteed income, once you have retired without affecting any tax free cash payable. More details are here, but in summary:

- Anyone can transfer their pension pots to Penfold via our site and use Guiide.auto.

- When you retire at some point in future, your final confirmed Guiide plan will be paid automatically, until you say otherwise.

- You no longer have to think about how much to take from month to month, it just gets paid.

- Where you have pensions and savings your Guiide plan will reduce the income tax paid, without lots of complex tax planning on your part.

- We help you track your remaining pension pots and long term plan over time in our Dashboard and Track page, so you don’t run out of money .

- You can still get ad hoc withdrawals tax efficiently, on top of your planned payments, if you need more money in any month.

- Once retired, you can buy some lifetime guaranteed income easily via Guiide, if ever wanted.

If this sounds good, then go to Guiide, build a plan and check out Guiide.auto in our new Dashboard feature