Why is it so complex?

To most people, pensions are incredibly complex: life expectancy, investment choices, cash flows, annuities, drawdown rates, tax and charges are some of the many issues to take into account.

Is it more simple than that?

Since the Pension Freedoms came into play, people have essentially two choices at retirement. These choices may be called a host of technical terms, but in essence the choice is simply between:

- Annuity: Paying your pension pot to an insurer for a guaranteed income for life.

- DIY: Managing your own money and taking it when needed.

Whichever you choose: what is a good outcome?

A good outcome is one where you (and your dependent if applicable) receive the income you need each and every year for the rest of your life.

If you achieve this, the retirement outcome has been a success. If not, then it hasn’t achieved the best outcome – either because you didn’t get what you needed each year, or you ran out of money.

Which option do you choose?

The annuity route will provide a set income for life. This income is known in advance and it won’t matter how long the person lives for, or whether the market fluctuates. Once you buy your annuity you know what you will get and don’t need to give it any more thought. These guarantees do cost money however, and may make an annuity appear expensive.

The DIY route involves some risk, as well as time and management from year to year. This means the first question you need to ask yourself when picking a retirement route is:

Can I accept any risk at all of running out of money?

If the answer is no, then the option is clear: the annuity route is the only option you should take, as it is the only one which guarantees you won’t run out of income completely.

If the answer is yes the next question should be:

Do I want flexibility from year to year when it comes to my income?

If the answer is no, then you can choose between an annuity or the DIY route. You’ll want to consider the best outcome for you and whether you may get a higher income following the DIY route. You’ll also want to consider whether this possible higher income outweighs the risks with managing your retirement yourself.

If the answer is yes, then only the DIY route can give you flexibility. This is shown in a simple example below.

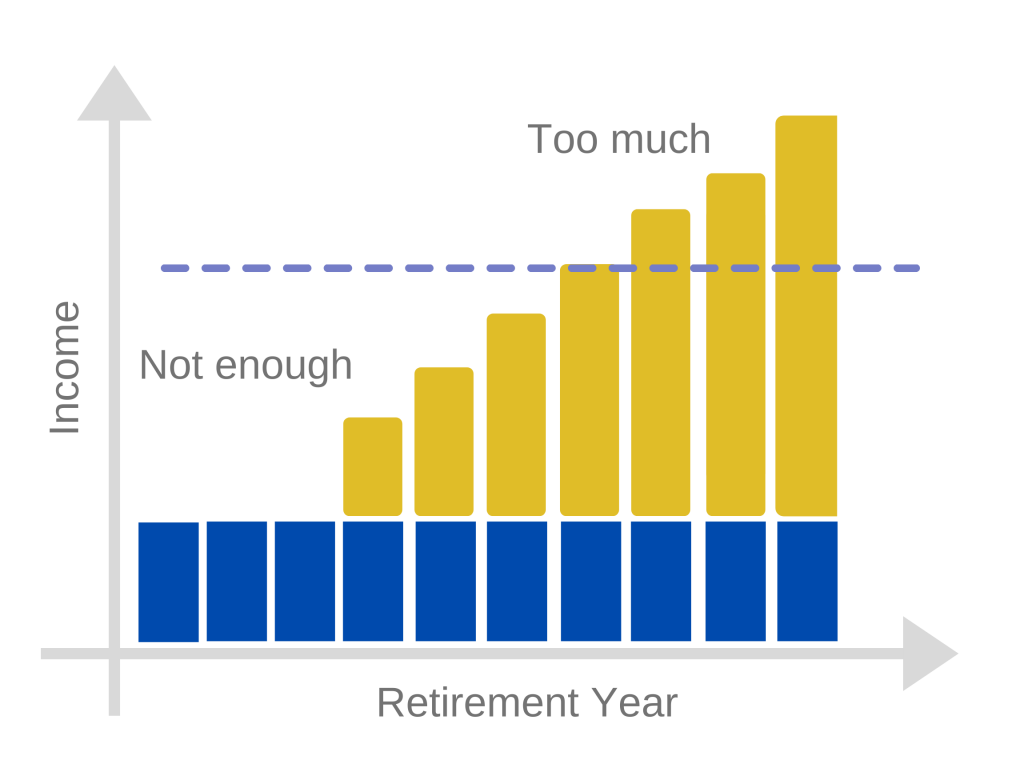

Most people will already get a fixed guaranteed income in retirement starting at State Pension Age from the government (shown in yellow). Unless you wish to retire exactly on State Pension Age (which most people don’t) an annuity income (shown in blue on the left hand chart) will give you a lumpy overall income when combined with the State Pension.

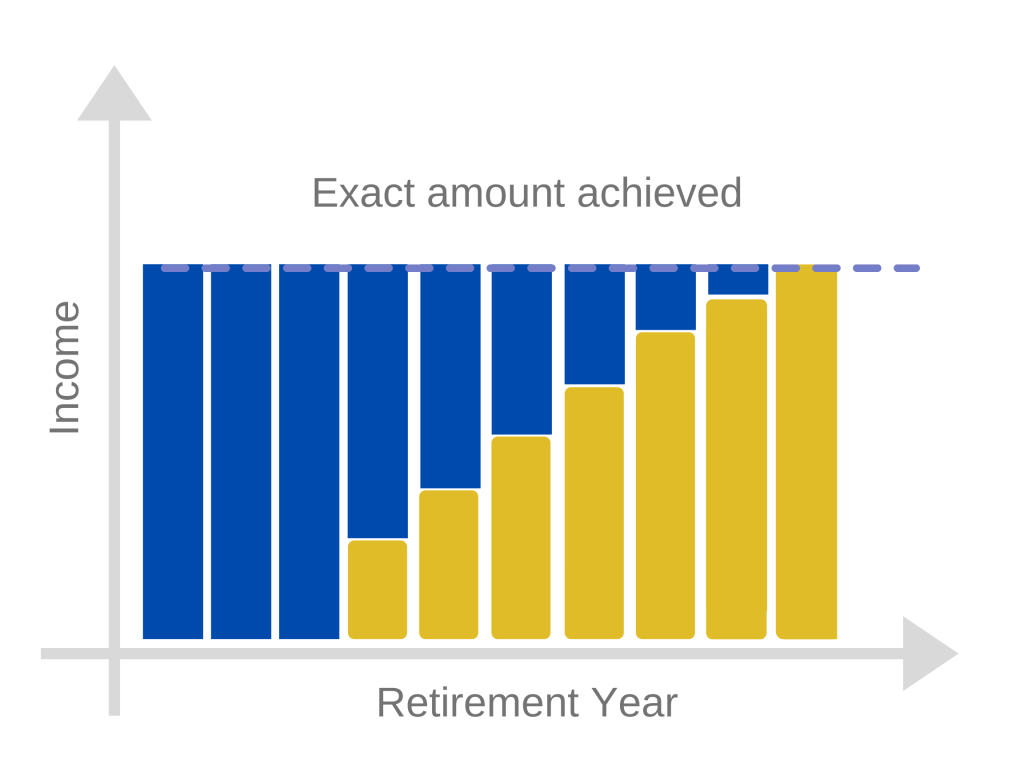

With the DIY route, you can decide how much to take in any year allowing you to fill the gaps (shown in blue on the right hand chart) between what you want and the State Pension .

What else do you need if you choose DIY?

If you prefer flexibility and want to receive a smooth total income from year to year (plugging the gaps between what is wanted and other fixed retirement income) the DIY route is the only path to achieve this.

In a perfect world, everyone who picked the DIY option would have an expert financial adviser to help them manage their pension investments and income. In reality, this just does not happen, possibly due to high perceived costs and perhaps other reasons.

In order to reduce the risk of running out of money or not receiving the income you want (i.e. a good retirement outcome), it’s worth getting initial and ongoing help to build a plan and monitor its progress.

This help must be free, simple and easy to understand,otherwise it’s of no benefit to the millions of people who need it.

We built Guiide, our retirement calculator, for precisely this reason, to provide the free, simple help people need to allow as many as possible to achieve a good retirement outcome.