What is retirement income?

Retirement income is the money that you’ll have to live on once you’ve retired. When we talk about retirement income, we mean the total income you have each year. That also means after tax (as you don’t get to spend what the taxman takes off you!)

This will include anything you take from your pension pots annually, income from the State Pension and from old final salary schemes you may have (if you are lucky enough to have one). Plus you might have other income from savings or ISAs, and other sources of money such as part-time work, or maybe some rent from a property that you let.

Why does the shape of my retirement income matter?

Unfortunately £1,000 in 10 years’ time won’t buy as much as £1,000 today. That’s because of inflation, which makes the price of goods and services rise over time. If prices increase, your spending power with the same income falls each year.

But how can you predict the effect that inflation will have over time and adjust your retirement income to match? It’s almost impossible. The next-best option is to choose an income which will increase each year based on an informed guess of what inflation may be.

There are different shapes of retirement income which give you different levels of spending power over time. We look at the three main options below and explain the pros and cons of each. You can decide what may be best for you and manage this through your pension choices.

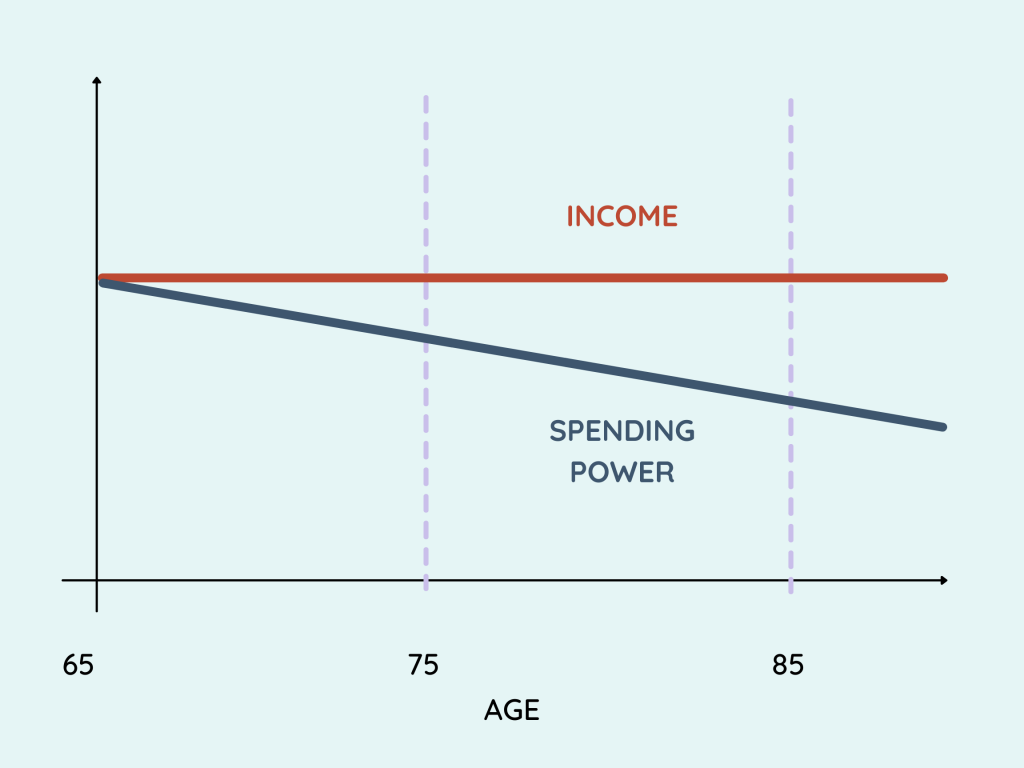

Flat shape

What is it? A flat income stays the same forever. You get the same amount of money every year throughout your retirement.

Pros – With the same size pot you could give yourself a higher income at the start of your retirement, as you won’t have to allow for increases over time. This might be good if you want more money in the early years when you are active and can enjoy it more.

Cons – As your spending power falls over time, you may end up with a very frugal lifestyle, even possibly with real hardship, in later years.

Verdict – Think about the minimum amount of money you’ll need in retirement, then double it. If you have enough money in your pot to meet that second figure every year for the rest of your life, this option could work for you. As your spending power erodes over time, you can then be confident that you’ll still have enough to cover all your needs and avoid poverty in later years. People with health issues that affect their lifespan may also prefer a flat income as more money is available early on.

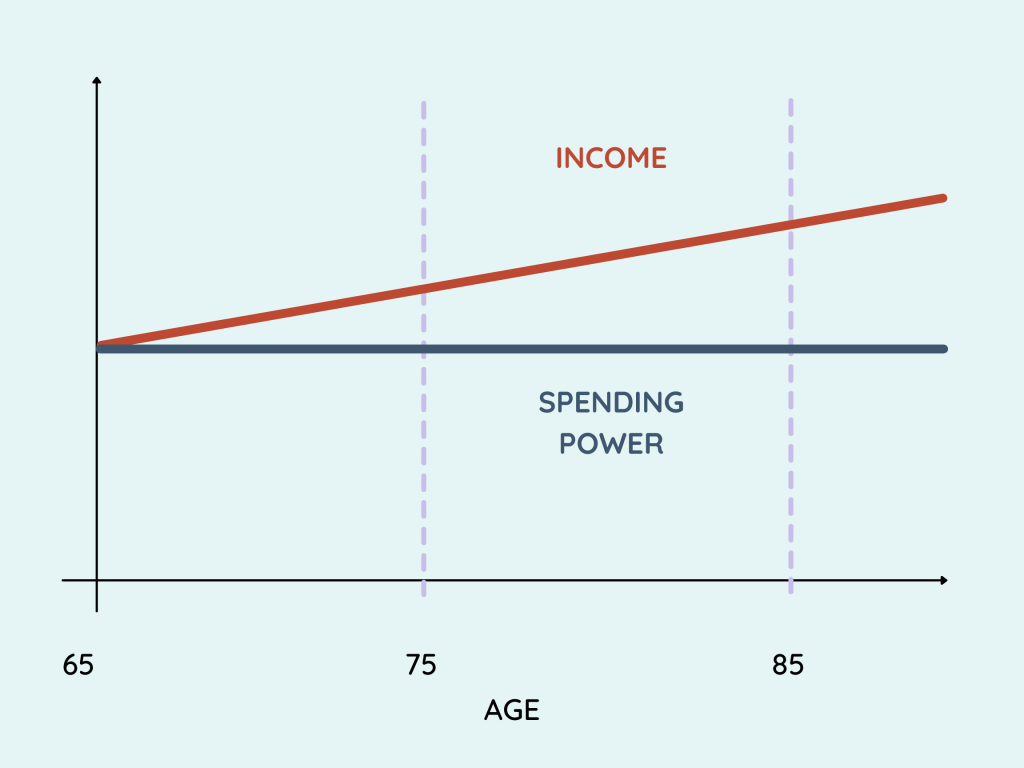

Increasing-for-life

What is it? Your income increases each year with the aim of giving you the same spending power at 85 and beyond as you had at 65 (or whenever you start to take your pension).

Pros – If you have enough to live on at 65, you should still be comfortably off at 85. Your spending will reduce naturally as you become less active, but you’ll have the same spending power.

Cons – With the same size pension pot as above, to make sure you’ve got enough money to allow for increases over the years, you’ll need to start your retirement with a much lower income, than if you choose the flat shape. It may not match the way that you are likely to spend your money during retirement.

Verdict – An increasing-for-life shape suits those who can afford to take a lower income in earlier years, in return for security of spending power in later years. If you are in good health and likely to live for a long time, this works well. But, it might mean you have less money to spend in the early years of retirement when you can make best use of it.

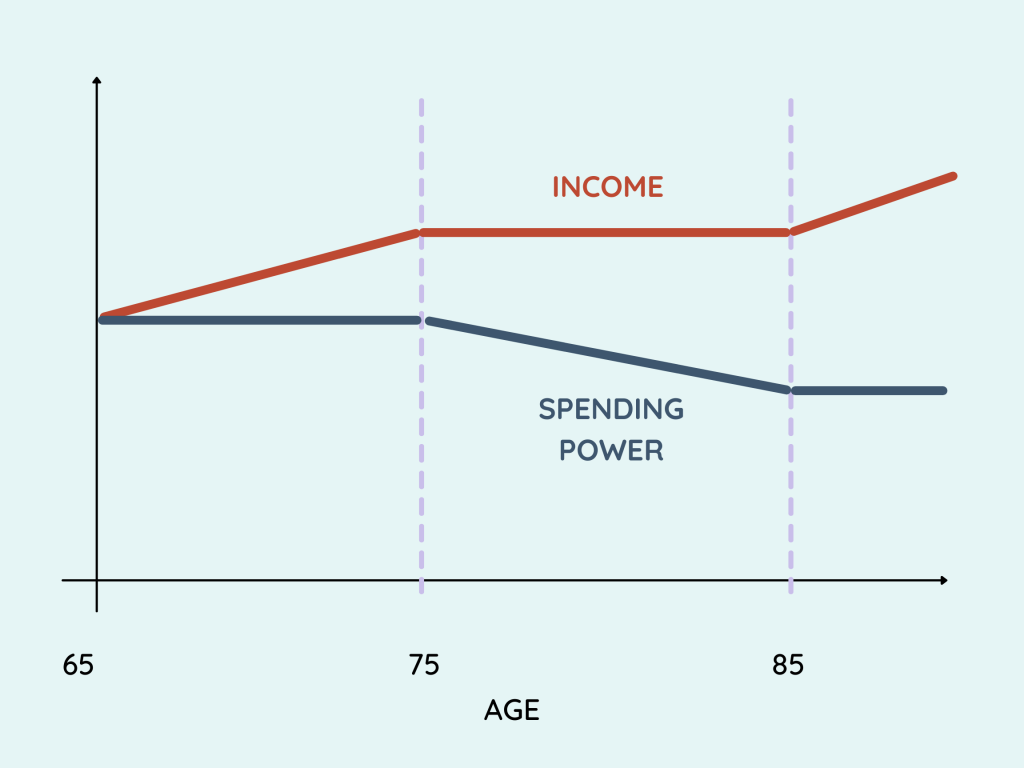

Typical spending

What is it? This option aims to give you an income that matches a typical retiree’s spending. That way, you have the income you may need at different stages of your retirement.

Pros – You’ll keep the same spending power in the early years of retirement when you might want more money to enjoy your new found freedom, but still have the money you need in later years when you may only be buying essentials. With the same size pot, you can take a higher starting income than using an increasing-for-life shape.

Cons – Your spending power decreases during the middle years of retirement as you become less active, which could mean you have to adopt a more frugal lifestyle. Your starting income when you first retire will be lower than for the flat shape. If your spending during retirement is different from a typical retiree, you could find that your income doesn’t match your needs. It’s also a much more complex option than the other two.

Verdict – Like Goldilocks, this option is in the middle, somewhere in-between the flat and increasing-for-life shapes. It has some of the benefits of each. There’s less risk of your spending power being seriously reduced in later life than with a flat shape. But it also means your starting income won’t be so low that you can’t enjoy your money while you are able to.

How do I manage this?

Typical spending is a much more difficult shape to manage than flat or increasing-for-life. You need to plan it yourself at retirement and balance up the flexible parts of your income (pension pots and other savings pots) around your other, fixed sources of income to give you the right amount.

That’s where Guiide comes in. We will shortly be adding Typical Spending to our choice of income shapes alongside Flat and Increasing-for-life.

Whatever shape you choose, it’s pretty complicated to work out for yourself how much to take from your pension and savings pots to give you the total income you want after tax each year.

No worries, Guiide will work all this out for you. Even better, we have now launched Guiide.auto with Penfold. This means:

- Anyone can transfer their pension pots to Penfold via our site and use Guiide.auto.

- When you retire at some point in future, your final confirmed Guiide plan will be paid automatically, until you say otherwise.

- You no longer have to think about how much to take from month to month, it just gets paid.

- Where you have pensions and savings your Guiide plan will reduce the income tax paid, without lots of complex tax planning on your part.

- We help you track your remaining pension pots and long term plan over time in our Dashboard and Track page, so you don’t run out of money .

- You can still get ad hoc withdrawals tax efficiently, on top of your planned payments, if you need more money in any month.

- Once retired, you can buy some lifetime guaranteed income easily via Guiide, if ever wanted.

If this sounds good, then go to Guiide, build a plan and check out Guiide.auto in our new Dashboard feature